US Dollar Rally: Riding the Wave of Resurgence

Updated Aug 02, 2023

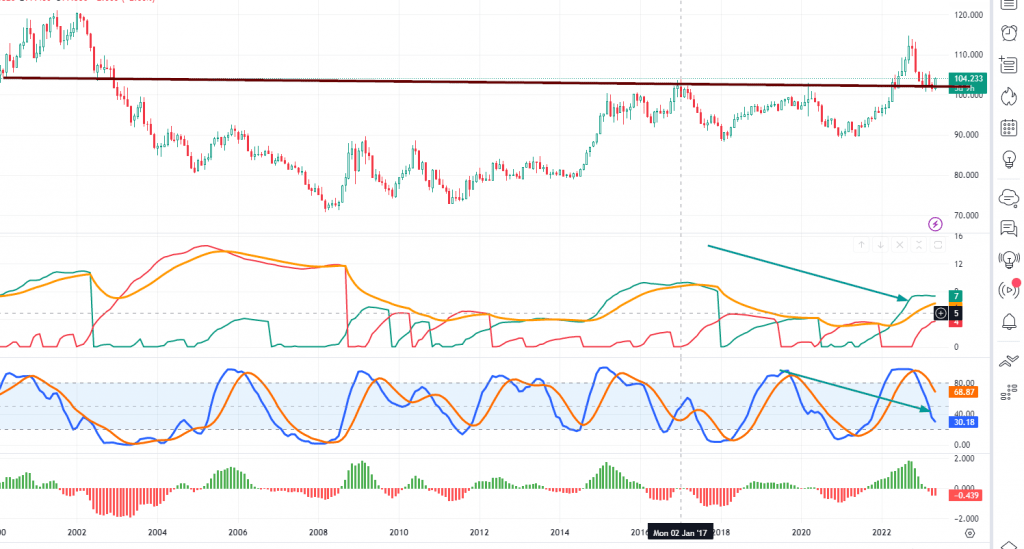

The weekly chart (below) shows a positive divergence signal triggered by the Dollar. It traded below its Jan 2023 lows, but the MACDs put in a higher low. There appears to be a triple bottom formation in the Dollar and double bottom in the MACDs.

This indicates a potential reversal in the Dollar’s trend, which could affect the broader Market. A stronger dollar is generally not good for the markets over the short-term timelines, especially for overextended stocks pushed higher by a frenzied crowd infatuated with AI but does not understand anything about it other than the word itself.

The monthly chart of the dollar

The monthly chart reveals an intriguing outlook. The MACDs are trading in the oversold range and could dip into the highly oversold zone. What’s noteworthy is that this shouldn’t have happened. Typically, the MACDs should have undergone a slight pullback. The Dollar should have rallied, triggering a negative divergence signal (a higher high in the Dollar followed by a lower high in technical indicators like MACDs) and subsequently entering a multi-year correction. However, the Dollar’s behaviour indicates that the next rally phase could last longer than initially projected.

Suppose the Dollar can close above 105.50 on a monthly basis, and the MACDs experience a bullish crossover. In that case, the odds of the Dollar testing 120 would rise significantly. Despite the world’s talk of the Dollar’s demise, this potential reversal could surprise many. The last component, mass psychology, is the most important. If the masses and the world at large believe the Dollar is doomed, then the opposite will come to pass. Massive change often occurs when no one expects it. Similar to the unexpected debut of ChatGPT, a significant reversal in the Dollar would come as a surprise to everyone.

However, we discussed this massive AI trend years before it started, and what we see now is that companies only need to mention the word AI and the stock jumps. Marvel is a perfect example of this phenomenon, and when they highlighted their focus on AI, the stock soared. This is a classic example of FOMO (fear of missing out).

The Dollar has experienced a noteworthy multi-year rally, but what we have observed so far is just a pop. To indeed confirm a significant reversal, we need a big bang.

Random closing thoughts on the Dollar

The prevailing expectation of a decline in the dollar’s value increases the likelihood of the opposite scenario unfolding. However, this reversal is expected to begin gradually and gain momentum quickly. It is often the outcome that is least anticipated that materializes.

If we were to make an educated guess, the dollar would gain momentum precisely when this market is positioned for a significant pullback. Our suspicion aligns with the Russell 2000 index testing the range between 1980 and 2000. Why? The Russell is currently the only major index trading in the oversold territory on the weekly charts. Significant corrections occur when all major indices are in the overbought zone, and market sentiment is excessively optimistic. This crowd is nearing the euphoric level after three weeks of bullish readings, indicating a potential turning point. Ideally, the bullish sentiment would trade in the range of 51 to 55. More information on this will be provided in the next update.

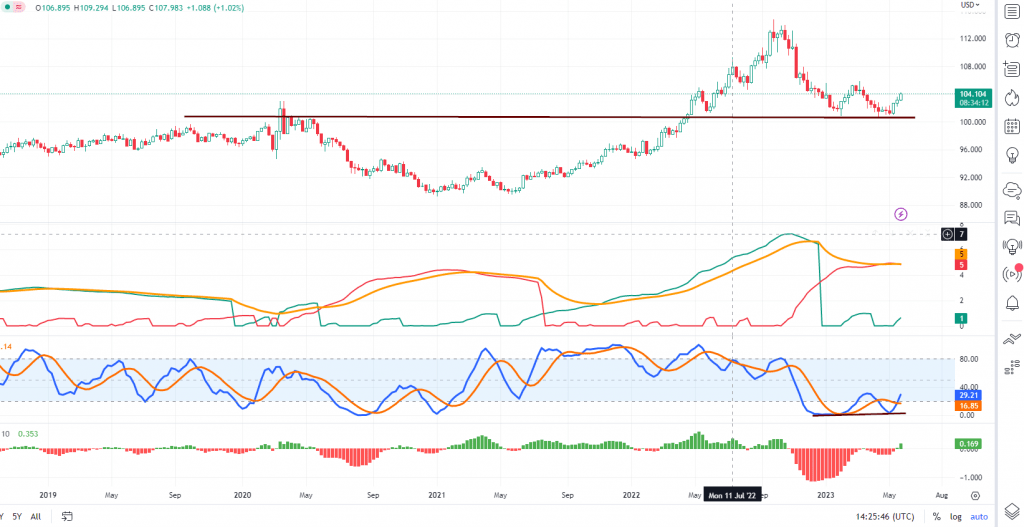

Dollar Rally Update Aug 2, 2023

The dollar has rapidly transitioned from being overbought to entering the oversold zone, achieving this cycle astonishingly quickly. The last time this cycle occurred, it took around 17-18 months, but this time it might complete within just nine months or even less. If it finished before this month’s end, it would have done so 50% faster.

Interestingly, despite the increasing number of articles predicting the dollar’s downfall, the least probable outcome often tends to unfold from a market perspective. Therefore, we should anticipate a strong and sudden rally from the dollar. More detailed information can be found in the “Dollar update” section.

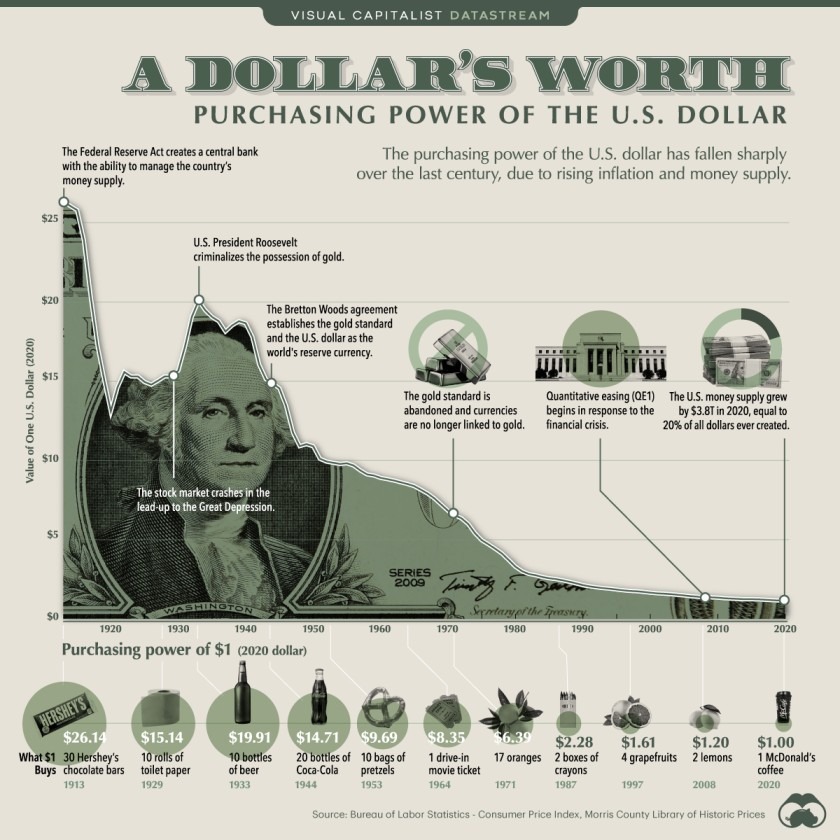

Courtesy of visualcapitalist.com

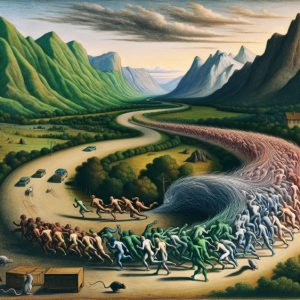

Nevertheless, it’s essential to keep in mind that while the dollar might appear strong compared to other currencies, all of them are fundamentally flawed. They are part of the same system, and there won’t be an honest government or central banker until the era of fiat money ends.

The race to the bottom among currencies is ongoing, and that’s why the purchasing power of the dollar has already eroded by over 90%. The term “strongest currency” is relative, as there is no fixed standard, and the illusion of strength is used to mask the fundamental weaknesses of all currencies. For instance, in 1913, the dollar could buy 30 Hershey bars, but today, it can hardly buy one, perhaps just a cup of mediocre coffee at McDonald’s.

Discover More: Stimulating Articles That Will Captivate You

Current Market Sentiment Indicators: Spotting Market Moves

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Contrarian Investing: The Art of Defying the Masses

Stock Market Psychology Chart: Mastering Market Emotions

Murphy’s Law and the Stock Market Fear Index: A Cautionary Tale

The Yen ETF: A Screaming Buy for Long-Term Investors

Contrarian King: Investing Beyond Fad Trends

Embracing Contrarian Meaning: The Magic of Alternative Perspectives

When is the Best Time to Buy Stocks?: Strategic Approach

Examples of Groupthink: Instances of Collective Decision-Making

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives